УДК 330.35

DOI 10.24412/2413-046Х-2021-10359

ИССЛЕДОВАНИЕ ВЛИЯНИЯ ИНОСТРАННЫХ ИНВЕСТИЦИЙ НА ЭКОНОМИЧЕСКИЙ РОСТ В ГАНЕ

THE EFFECT OF FOREIGN INVESTMENTS ON ECONOMIC GROWTH IN GHANA: AN EMPIRICAL STUDY

Донкор Теттех Даниил, Институт промышленного менеджмента, экономики и торговли Санкт-Петербургского политехнического университета Петра Великого

Козлов Александр Владимирович, д.э.н., профессор Института промышленного менеджмента, экономики и торговли Санкт-Петербургского политехнического университета Петра Великого

Donkor Tetteh Daniel, Institute of Industrial Management, Economics and Trade, Peter the Great St. Petersburg polytechnic university,

Kozlov Aleksandr Vladimirovich, DSc(Ec), professor of Institute of Industrial Management, Economics and Trade, Peter the Great St. Petersburg polytechnic university

Аннотация. Актуальность исследования определяется насущной необходимостью определения путей, факторов и инструментов повышения жизненного уровня в странах Африки, условием которого является устойчивый экономический рост. Целью исследования является оценка влияния иностранных инвестиций на экономический рост в Гане, стране, расположенной на западе Африканского континента. Методология исследования базируется на применении аппарата эконометрики, тестирования коинтеграции по Йохансену, а также использовании расширенного метода Дики-Фуллера. Результаты исследования показали, что иностранные инвестиции стимулируют экономический рост в долгосрочной перспективе, но в краткосрочной перспективе они способствуют минимальному или незначительному росту. В исследовании даны рекомендации правительству принять стратегии, которые привлекут на основе слияний и создания совместных предприятий больше местных инвесторов для экономического роста в стране. Также необходима обратная связь для быстрого стимулирования секторального роста и либерализация политики выхода на рынок, формирование прозрачных и стабильных условий для местных и иностранных инвесторов. Выделены задачи инфраструктурного развития, в частности, формирование рынка квалифицированной рабочей силы и создание системы налоговых льгот для инвесторов. Авторы сформулировали ограничения выполненного исследования.

Summary. The importance of this paper is defined by utmost need to identify ways, factors and tools providing higher living standards for the whole population of African countries which can be based on sustainable economic development. The goal of the study is to critically assess the impact of a such important factor as foreign investment on economic growth in Ghana located in West African sub-region. The study employed Johansen cointegration, Augmented Dicky-Fuller, and the Auto Regressive Distribution lag econometrics technique to produce robust findings. Results from the study showed that foreign investment drives economic growth in the long but in the short run it fosters minimal or insignificant growth. The study recommends that the government should adopt strategies that will attract more local investors to boost the country’s productivity, mergers and joint ventures. Backward and forward linkages to rapidly drive sectoral growth and also liberalized market entry policies to offer open and reliable conditions for local and foreign investors. The tasks of infrastructural development are highlighted, in particular, the formation of a qualified labor market and the formation of a system of tax incentives for investors. The authors formulated the limitations of the study.

Ключевые слова: иностранные инвестиции, экономический рост, эконометрические методы, Западная Африка, Гана.

Key words: foreign investment, economic growth, econometrics, West African sub-region, Ghana.

Introduction

Foreign Investment (FI) is one of the most relevant aspects of the recent wave of globalization as it has become an important tool in achieving sustained growth and it’s regarded as the major driver of nations’ economic development [1]. It is seen as a situation where a company finds a lasting interest in investing in another company in a different country. The study [2] identifies it as a critical factor that propels economic growth. The paper [3] also defined it as a situation where a foreign investor investment gains some level of influence in the management of an entity outside the investor’s home country.

Studies on foreign Investment however have been mostly centered on the effects and growth in developed countries rather than in developing countries, and a few on the West African sub-region [4, 5]. The studies show that developed countries have an absorptive capacity to benefit from the spills FI brings. The authors of [6] presenting analysis on the effects of FI between (1984-2010) conclude that FI brings about some level of growth in developed economies. Similar studies in France, Australia, and other developed countries also outputted positive impact of FI [7]. The study [8] using single-country research, in contrast, concludes that FI has no significant positive effect on economic growth. Studies in developing countries also show mixed results, for instance the study [9] focused on mergers and acquisitions in developing countries resulted that FI does not bring about any increase in an economy capital stock. Krugman&Obstfeld, on the contrary, stated that FI brings into developing countries the control of resources [10].

Ghana’s position in the past on FI and its effects on growth was controversial. FI was seen as a tool for neocolonialism and western capitalist exploitation [11]. In recent years, however, there have been significant inflows of FI in Ghana. Between the years 2006 and 2016, the country was ranked among the high receiving economies of the inflows of FI in Africa. Studies in Ghana have also shown the positive spills of FI in the country. [12] a study using time series analysis approach on these variables; inflation, gross fixed capital formation, trade openness, and government spending for the period 1983-2012, concluded that there is a positive effect of the introduction of FI in Ghana.

Ghana however has seen some level of FI inflows but its net percentage to gross domestic product (GDP) is still low. The total inflows of FI Globally summed up to $1,5 trillion in 2019. From these developing countries recorded 72% amounting to $616 billion. Africa recorded a total FI of $38 billion in 2019. In Ghana, the FI stock was USD 38,5 million. The mining and oil sector, service, and agricultural sectors are areas that facilitate major inflows of FI in the country [13].

Although the country is recognized among high receiving economies of FI inflows in Africa its developmental impact on growth is not felt by the people. A major problem exists in the country; unskilled workforce, low productivity, high inflation, lengthy bureaucratic process, low technology, insufficient facilities and weakness in infrastructures, insufficient tools, and equipment, weak financial systems, and poverty are still high. This, therefore, defined the goal of the study to assess the impact of FI inflows on economic growth in the country.

Literature review

Lack of capital in developing nations has compelled policymakers to seek for foreign investors to invest in their country to achieve rapid growth. Data from developed countries states that these benefits associated with the inflows of foreign investment come with some underlying conditions.

Many past studies revealed that foreign investment impacts economic growth, but this growth is determined by the elasticity of the demand and supply linkages of foreign investors and local firms. It is therefore crucial for policymakers to attract more foreign firms/investors toward local companies that are capable of ensuring increased spillovers and linkage to achieve growth. Also, there should be flexibility in the demand/supply trade between foreign firms/investors and local companies.

Rodriguez-Clare [14] addressed foreign investment in developing countries in a seminar paper. He stated that the positive spillover of foreign firms to host countries depends on the ability to generate backward linkage compared to domestic firms. He further explained the backward linkage of foreign and domestic firms as the ratio of employment generation in industries to employed labor directly by the firm. This theory is based on two assumptions, 1. If the linkage gained by foreign firms is bigger than domestic companies, it will result in the introduction of new technology, increased wages, and productivity gains by domestic firms. Countries with good infrastructures and big manufacturing companies will generate positive spillovers concerning their linkage with foreign firms. 2. If there is a stronger linkage, the productivity of domestic firms will be improved via a forward linkage such as the introduction of technological inputs. Markusen and Venables [15] argue that the entry of international firms in receiving countries can have two separate effects: The competition effect and the Linkage effect. Foreign firms investing in developing countries’ markets can bring about tougher competition which will heavily impact the performance and patronization of domestic products. However, the competition will also bring about price reduction whilst ensuring quality. Concerning the linkage effect, the inflows of foreign investors to the local firm will ensure an increase in demand for local produce. That is the effect will ensure that intermediate goods producers are capable of generating an esteemed situation that could be beneficial to domestic final-goods producers.

S Wajid (2017) [16] using time series data based on cointegration for the period 1990-2015 showed robust correlation among the variables in the run. The findings further showed that in the long run FI is a significant factor for growth but not in the short run.

Lin and Saggi (2007) [17] show that there has been increased interaction and linkage of domestic suppliers due to the increasing number of foreign investors/firms. To the linkage effect, foreign investments come with increased opportunities for developing countries, some include, creating market accessibility, staff development, and training, transfer of technology, the commencement of new projects and processes, productivity gains, adopting new managerial skills and know-how in the domestic market and establishing a network of contacts internationally. Njangang et al. (2018) [18] using a three-panel data study; Low-income countries, lower-middle-income and upper middle income for the period 1980- 2016 concluded that country’s with weak institutions deters growth. This is a result of political instability, corruption, and high taxes. These factors make it difficult for investors to predict the returns on their investment.

Furthermore, for a country to fully grasp the positive shocks associated with foreign investment, its level of development has to be on the rise. It is therefore necessary for developing countries to adopt a system that will open if financial markets to new entrepreneurs, new technologies, and new managerial skills. Entrepreneurs have a major influence in domestic and export markets. Also, mergers and acquisitions bring about a well-functioning stock market. This further increases the sources of funds available to business owners and also creates a market for foreign and domestic investors.

Makki & Somwaru (2004) [19] using SUR technique in it survey analysis of 66 developing countries within the periods (1971-1980, 1981-1990, and 1991-2000) concludes that there is a positive effect on the growth of foreign investment per se and a positive effect of the relationship between trade openness and foreign investment. Hansen & Rand (2006) [20] postulate that foreign investment has a positive effect on GDP. In their examination of foreign investment and gross domestic product (GDP) in a sample of 31 developing countries for the period 1970-2000 using heterogeneous estimators of panel data, they discovered a cointegration between foreign investment and GDP. The analyses showed evidence of foreign investment impact on GDP but not in the case of GDP impact on foreign investment in the long run. It was also discovered that foreign investment has a higher ratio of gross capital formation effect on GDP. They concluded that Foreign investment has an impact on GDP through education, knowledge transfers, and adoption of new technologies.

Conversely, Lyroudi et al. (2004) [21] studies revealed that there is no significant positive spill-over effect on growth for developing countries.

In summary, most of the empirical analysis of foreign investment on growth has shown that transition economies must attain a certain level of growth, both economic and technological before it can generate the positive effects spillover effects foreign investment brings. However, advanced technologies will also require the absorptive capacity of the receiving country, its adequacy of human capital, market access, domestic investment, and high savings rate. This was evident in many past and recent researches such as Akin & Appiah, Li, Frowne, Donkor [22,23]. Thus, the literature overview confirmed the topicality of the study on impact of FI on economic growth on one hand and the lack of studies focused on West African sub-region’s developing countries in total and Ghana, in particular.

Data, Model, and Methodology

Data & Model

The variables employed in the study include Foreign investment, financial development, industrialization, and growth. Growth is the dependent variable whilst foreign investment is the independent variable, and the others are control variables. The study used a secondary source of data collected from the world bank database [24]. The period covers 1990 – 2017.

To determine the effects of foreign investment on economic growth. To evaluate the factors that contribute to economic development, the analysis uses an econometric model based on the following:

GRt=αt+β1FI+ β2FDt+ β3INDt+εt

Where GR is economic growth measured in Current USD, FI is foreign investment, FD is Financial Development, and IND (Industrialization)), with t as the time and α represents the intercept.

Methodology

The study was carried out to critically assess the impact of foreign investment in Ghana. To achieve this the study employed the following techniques. First, the study used a unit root test to check the stationarity of the variables. This is very important as it helps in determining the correct data trend. The ADF by H. M. Pesaran (2007) [25] establishes the unit root test uses cross-sectional dependency by expanding the ADF regression with cross-sectional averages in level and fist difference. Testing the variables in Level and first difference helps to know their integration sequence.

The outcome of stationarity among the variables spun the continuous study, to test for long-run cointegration between the dependent and independent variables. In testing the long run, the study employed the Johansen Cointegration test. Johansen’s cointegration test by Johansen (1988) [26] is used to determine the validity of cointegration links using maximum likelihood estimates.

The ARDL techniques followed up from the Johansen tests because there was the existence of a long or long-run relationship between the dependent and independent variable (foreign investment and growth). ARDL is an ordinary least square (OLS) technique that is suitable for both short- and long-term nonstationary variables and also, time series with mixed order of integration. ARDL technique can be used for small sample size and data, and it is also able to combine variables at both levels and first difference. Duasa (2007) [27] asserts that ARDL can accommodate different variables which have different lags but not so with the standard cointegration test.

Results and discussion

This chapter presents the results and discussions of the findings of the methodology. It examines the relationship amongst all the variables (growth, foreign investment, financial development, and industrialization). It uses descriptive & correlation statistics to give comparative analysis to the study, unit root to determine the stationarity of the variables, cointegration to establish if there is a linear long-run relationship among the variables and finally testing for the causality of the long-run and short-run links amongst all the variables.

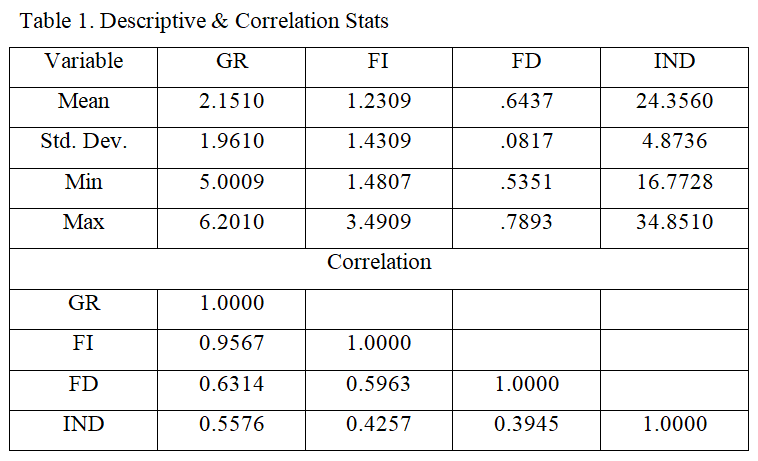

Descriptive and correlation statistics enable comparative analysis of the study. In using descriptive analysis, the mean, standard deviation, minimum and maximum figures of the dependent and independent variables depict varying results (Table 1). Summary of the results showed that foreign investment has a mean value of 1.2309 and a standard deviation value of 1.4309 whilst Growth has a mean value of 2.1510 and a standard deviation figure of 1.9610. Minimum and Maximum values showed a high-level increase in growth, 5.0009 and 6.2010 respectively. Concerning foreign investment, they outputted 1.4807 and 3.4909. Financial development however recorded decreasing values, a standard deviation, and a mean value of 0.0817 and 0.6437. Industrialization also showed an increasing mean value of 24.3560 and a decreased standard deviation value of 4.8736. Minimum and Maximum values depicted increasing values, 16.77728 and 34.8510 respectively.

Furthermore, the outcome of correlation statistics shows that all the independent variables thus Foreign investment, financial development, and industrialization all exhibit a positive relationship with growth. The correlation between foreign investment and growth is 0.957%, financial development and growth is 0.6314%, and industrialization and growth is 0.5576%.

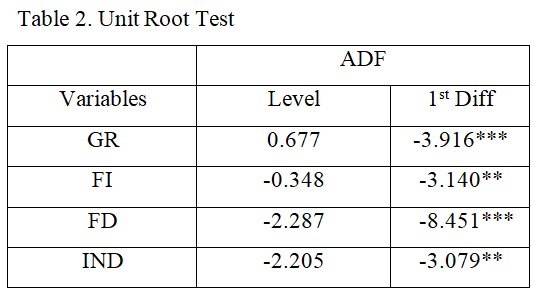

To determine the impact of the foreign investment in Ghana, the status of stationarity of all variables (GR, FI, FD, IND) has to be examined. This is done to ensure the effects of spillovers and also to determine that variables are stationary. Using Augmented Dickey-Fuller (ADF) [25] to test for the Unit root, the following outcomes were shown. All the variables when tested were not level at stationary but they were stationary at first difference. Foreign investment and industrialization became stationary after first differencing at a 5% significance level. Economic Growth and financial development became stationary after first differencing at a 1% significance level.

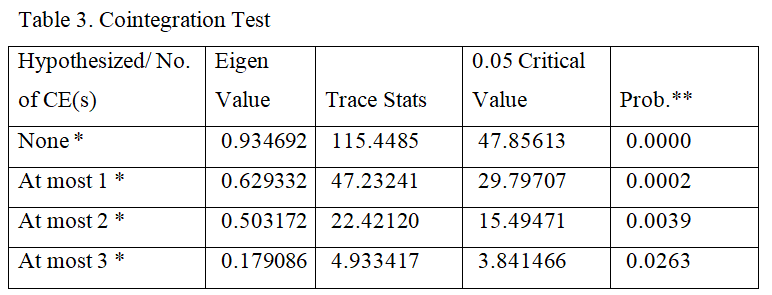

A cointegration test is carried out to establish if there is a linear long-run relationship among the variables. Johansen (1988) [26] therefore states that cointegration enables us to specify a process of adjustment among the variables of interest and also in disequilibrium markets. It is therefore evident from Table 3 that trace statistics show the presence of cointegration among the variables. A null hypothesis, trace statistics show a greater value of 115.4485, to a 5% critic value of 47.85613. At most one long relationship also showed a greater value of 47.23241 to a 5% critic value of 29.79707. Results from the tables give evidence to support that there exists a long-run relationship between foreign investment and economic growth.

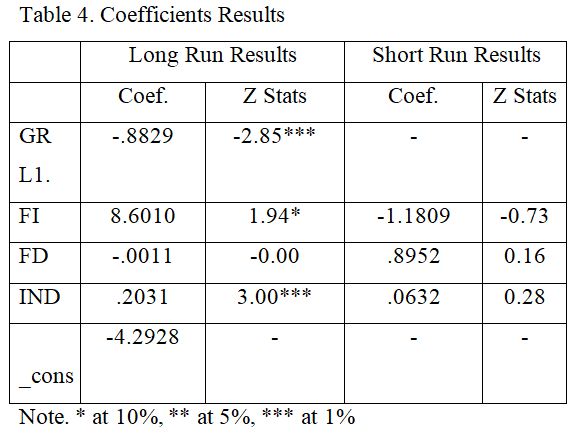

The importance of the inflows of foreign investment on economic growth has led to the measurement of these results by examining its effects in the long run and short run. The resulted calculation is shown in table 4. The impact of Foreign investment on economic growth, in the long run, increases growth in receiving economies. Statistical results show that a percentage increase in foreign investment will increase economic growth by 8.6010% and significance level at 10%. The inflows of FI into Ghana will improve and trigger the human and physical capital through the development of their abilities. Gross domestic product is likely to increase as production will rise through the enhancing of labor output and the introduction of new technologies in production. Foreign investment also brings about growth through industrialization. Through this FI creates employment opportunities for the populace hence increasing the standard of living. A. S Wajid (2017) [19] in his study using time series data from 1990 to 2015 base on unit root test showed stationarity. He discovered robust proof for the correlation between foreign investment and growth in the long run. He further stated Foreign investment brings about an improvement in the labor force as it finetunes the skills of personnel and also gives them proper training regarding modern technology. In the short run, however, foreign investment impact on growth is minimal. Statistical evidence is shown in table 4 as an increase in financial development in the short run led to a minimal increase in the economic growth of -1.1808%. Njangang et al. (2018) [19] using a three-panel data study; Low-income countries, lower-middle-income and upper middle income for the period 1980- 2016 concluded that in the short-run the effects of foreign investment on growth are insignificant. The minimal impact of foreign investment on economic growth is a result of political instability, corruption, and high taxes. These factors make it difficult for investors to predict the returns on their investment.

Also, there is a minimal impact of Financial Development on economic growth in the long run unlike in the short run. The results show that the impact of financial development on economic growth, in the long run, will lead to a negative 0.0011% decline in growth but in the short run, it will output positive growth of 0.8952%. Transitioning countries like Ghana will enjoy economic growth when financial systems are improved. Financial development in the short run will influence the economy’s savings rate, propel mobilization of resources, investment, and imports and exports. In the short run, financial development will cause an increase in sectoral growth as active or good financial systems are more correlated with economic growth. In line with this, Gerschenkron [28] stated that the impact financial development will have on growth will depend on the backwardness of the receiving country. He further stated that due to this transitioning country needs a more active financial system. In the long run, however, financial development’s impact on growth is minimal. Demetriades and Hussein [29] in their study on causality analysis discovered minimal proof on the causality indicating positive spills financial development to economic growth in the long run. This was supported by Menyah et al. [30] whose study showed no causality associated with financial development on growth.

Moreover, the effects of industrialization on economic growth in both short-run and long-run. Statistical evidence showed that an increase in industrialization in both the short run will increase economic growth by 0.2031% and a significance level at 1%. and in the long run 0.632%. An increase in industrialization fosters economic growth as it brings about an increased employment opportunity, propels new technology and innovation, and increases the productivity output of the country, improves the per-capital income, and also brings poverty to a minimal level.

Overall, the results suggest a strong positive impact on FI flows in the long run and this is supported by many authors.

Conclusions, policy implications, and recommendation

The study was carried out to critically assess the impact of foreign investment. Careful discussion and analyses were carried out on the effects of foreign investment on economic growth in Ghana over the period 1990 – 2017. The study used the Johanson cointegration, Augmented Dicky-Fuller (ADF), and the ARDL (Auto Regressive Distribution lag) econometrics technique to produce robust findings.

Results from the study show that foreign investment drives significant economic growth in the long run but in the short run it fosters insignificant growth. Political turmoil and other social vices make the environment unconducive for foreign investors. Moreover, results from the study showed robust proof of the relationship between foreign investment and growth in the long run. Foreign investment brings about an improvement in the labor force thus, finetune the skills of personnel’s and also give them proper training regarding modern technology. Foreign investment also enhances growth through industrialization, and this creates employment streams and also increasing the standard of living.

However, the study covers one country only and it is based on analysis of foreign investment without distinguishing the direct foreign investments which is the most important factor for economic growth.

It was evident from the study that corruption and political instability deters foreign firms to invest. Again, foreign investment triggers an improvement in human and physical capital through the introduction of new knowledge and skills. Also, FI creates employment opportunities for the populace hence improving the standard of living in the country. The study however recommends that given the decrease of foreign investment on economic growth in the short run, the government should adopt strategies that will boost the output of local producers and also attract more local investors. For instance, mergers or joint ventures between foreign and local firms. Furthermore, strategies should be put in place by the government to strengthen the forward and backward linkages of foreign investment into the country. Backward and forward linkages will result in increasing the productivity gains by firms, upgrading domestic institutions, enhance labor outputs, improve the standard of living. Lastly, there should be a liberalized policy on market entry to offer open and reliable conditions for local and foreign investors, For example, access to affordable labor, and a reduction in taxes.

Список литературы

- Баджо-Рубио, О., Диас-Мора, С. и Диас-Ролдан, С. Иностранные инвестиции и региональный рост: анализ на примере Испании. Региональные исследования. 2010. 44 (3): 373-82. doi:10.1080/00343400802508844.

- Кой, А. Г. и Комикан, Х. Ф., Прямые иностранные инвестиции и экономический рост: подход к временным рядам, Журнал глобальной экономики, 2014. Том. 6 № 1, стр. 7-9.

- Соломон Э. Прямые иностранные инвестиции, факторы принимающей страны и экономический рост. Ensayos Revista de Economía. 2011. Том 30, № 1, стр. 4-7.

- Лукас Р. Э. Младший О механике экономического развития. Журнал денежно — кредитной экономики 1988. 22 (1): 3-42. doi:10.1016/0304-3932(88)90168-7.

- Гуринча, П.-О., Жанна, О. Потоки капитала в развивающиеся страны: загадка распределения. Обзор экономических исследований. 2013. 80 (4): 1484-515. doi:10.1093/restud/rdt004.

- Гарсия-Сантана, М., Мораль-Бенито, Э., Пихоан-Мас, Дж. и Рамос, Р. Растет, как Испания: 1995-2007. Рабочий документ 1609. Мадрид: 2016. Банк Испании. [Электронный ресурс] URL: https://www.cemfi.es/~pijoan/ Work_in_Progress_files/missallocation_Spain_v34.pdf.

- Бломстрем М., Липси Р. Э. и Зеян М. Чем объясняется рост развивающихся стран. Рабочий документ 4132. Кембридж, Массачусетс: Национальное бюро экономических исследований,Кембридж, Массачусетс, 1994. [Электронный ресурс] URL: http://www.nber.org/papers/w4132.

- Хорхе Бермехо Карбонелл, Ричард А. Вернер. Способствуют Ли Прямые Иностранные Инвестиции Экономическому Росту? Новый эмпирический подход, примененный к Испании, Экономическая география. 2018. 94:4, 425-456, DOI: 10.1080/00130095.2017.1393312

- Агосин М. (2000). Майер (). Иностранные инвестиции в Развивающиеся страны–Это толпа внутренних инвестиций. Документ, представленный на Конференции Организации Объединенных Наций (ООН) по торговле и развитию (ЮНКТАД). 2000. [Электронный ресурс] URL: http://www. unctad. org/ru/docs/dp_146. ru. pdf.

- Кругман П., Обстфельд М. Международная экономическая теория и политика (8-е изд.). США: Пирсон Аддисон Уэсли. 2009

- Циката Г. К., Асанте Ю. и Гьяси Е. М. Детерминанты прямых иностранных инвестиций в Гане, Институт зарубежного развития. 2000.

- Нкетсия, Исаак, Квайдуу Матфей. Влияние прямых иностранных инвестиций на экономический рост в Гане. 2017. 2. 227-232. 10.11648/j.jbed.20170204.14

- ЮНКТАД. Отчет о мировых инвестициях за 2020 год. Нью-Йорк: Организация Объединенных Наций.

- Родригес-Клэр, А. Транснациональные корпорации, связи и экономическое развитие. Американское экономическое обозрение. 1996. Том 86, № 4. 852-873.

- Маркузен, Дж. Р., & Венейблс, А. Дж. (). Прямые иностранные инвестиции как катализатор промышленного развития. Европейский экономический обзор. 1999. 43(2), 335-356.

- А. С. Ваджид, «Вклад ПИИ в экономический рост», Международный журнал экономики, торговли и управления. 2017. том № 2, 284-311.

- Лин П., Саджи К. Многонациональные фирмы, эксклюзивность и обратные связи. Журнал международной экономики, 2007. 71(1), 206-220.

- Ньянганг, Анри, Нембо Ндеффо, Люк, Нубисси Домгия, Эдмонд, Фосто Койеу, Долгосрочные и краткосрочные последствия прямых иностранных инвестиций, иностранной помощи и денежных переводов для экономического роста в африканских странах. Дата выхода: 2018.

- Макки С. С., Сомвару А. Влияние прямых иностранных инвестиций и торговли на экономический рост: данные из развивающихся стран. Американский журнал сельскохозяйственной экономики, 2004. 86(3), 795-801.

- Хансен Х., & Рэнд Дж. О причинно-следственных связях между ПИИ и ростом в развивающихся странах. Мировая экономика, 2006. 29(1), 21-41.

References

- Bajo-Rubio, O., Díaz-Mora, C., and Díaz-Roldán, C. Foreign investment and regional growth: An analysis of the Spanish case. Regional Studies. 2010. 44 (3): 373–82. doi:10.1080/00343400802508844.

- Coy, A.G. and Comican, H.F, Foreign direct investment and economic growth: a time series approach, Global Economy Journal, 2014. Vol. 6 No. 1, pp. 7-9.

- Solomon, E. Foreign direct investment, host country factors and economic growth. Ensayos Revista de Economía. 2011. Vol. 30 No. 1, pp. 4-7.

- Lucas, R. E. Jr. On the mechanics of economic development. Journal of Monetary Economics 1988. 22 (1): 3–42. doi:10.1016/0304-3932(88)90168-7.

- Gourinchas, P.-O., Jeanne, O. Capital flows to developing countries: The allocation puzzle. Review of Economic Studies. 2013. 80 (4): 1484–515. doi:10.1093/restud/rdt004.

- Garcia-Santana, M., Moral-Benito, E., Pijoan-Mas, J., and Ramos, R.. Growing like Spain: 1995–2007. Working Paper 1609. Madrid: 2016. Banco de Espagna. [Electronic resource] URL: https://www.cemfi.es/~pijoan/ Work_in_Progress_files/missallocation_Spain_v34.pdf.

- Blomström, M., Lipsey, R. E., and Zejan, M.. What explains the growth of developing countries. Working Paper 4132. Cambridge, MA: National Bureau of Economic Research,Cambridge, MA. 1994. [Electronic resource] URL: http://www.nber.org/papers/w4132.

- Jorge Bermejo Carbonell, Richard A. Werner. Does Foreign Direct Investment Generate Economic Growth? A New Empirical Approach Applied to Spain, Economic Geography. 2018. 94:4, 425-456, DOI: 10.1080/00130095.2017.1393312

- Agosin, M. (2000). Mayer (). Foreign Investment in Developing Countries–Does it Crowd in Domestic Investment. Paper presented at the United Nations (UN) Conference on Trade and Development (UNCTAD). 2000. [Electronic resource] URL: http://www. unctad. org/en/docs/dp_146. en. pdf.

- Krugman, P., & Obstfeld, M. International economics theory & policy (8th ed.). USA: Pearson Addison Wesley. 2009

- Tsikata, G.K., Asante, Y. and Gyasi, E.M. Determinants of Foreign Direct Investment in Ghana, Overseas Development Institute. 2000.

- Nketsiah, Isaac, Quaidoo Matthew. The Effect of Foreign Direct Investment on Economic Growth in Ghana. 2017. 2. 227-232. 10.11648/j.jbed.20170204.14

- UNCTAD. World Investment Report 2020. New York: United Nations.

- Rodriguez-Clare, A. Multinationals, linkages, and economic development. The American Economic Review. 1996. Vol. 86, No. 4. 852-873.

- Markusen, J. R., & Venables, A. J. (). Foreign direct investment as a catalyst for industrial development. European Economic Review. 1999. 43(2), 335-356.

- A. S. Wajid, «Contribution of FDI in Economic Growth,» International Journal of Economics, Commerce and Management. 2017. vol. no. 2, 284-311.

- Lin, P., Saggi, K. Multinational firms, exclusivity, and backward linkages. Journal of International Economics, 2007. 71(1), 206-220.

- Njangang, Henri, Nembot Ndeffo, Luc, Noubissi Domguia, Edmond, Fosto Koyeu, The long-run and short-run effects of foreign direct investment, foreign aid and remittances on economic growth in African countries. Prevost: 2018.

- Makki, S. S., Somwaru, A. Impact of foreign direct investment and trade on economic growth: Evidence from developing countries. American Journal of Agricultural Economics, 2004. 86(3), 795-801.

- Hansen, H., & Rand, J. On the causal links between FDI and growth in developing countries. World Economy, 2006. 29(1), 21-41.