DOI 10.24412/2413-046Х-2021-10196

The Elderly’ Adoption of Digital Banking: An Opportunity for Vietnamese Commercial Banks

Binh, Dao Thanh, School of Economics and Management of Hanoi University of Science and Technology, Hanoi, Vietnam, Email: binh.daothanh@hust.edu.vn

Summary. The rapid and disruptive development of digital technology in the digital age has changed the way people live in the world. The care for the elderly ensuring their wellbeing in old age in the context of global digital transformation is a matter of objective reality. Commercial banks, as a specific financial institution, are actively engaged in the digital transformation to become digital banking to improve banking services that meet customers’ requirements of all ages. The article provides an overview of digital banking content, the factors influencing the elderly’ adoption of Digital Banking and the need to adapt digital banking products for the elderly in the context of the digital transformation taking place in all areas of human life.

Key words: population aging, elderly, digital transformation, digital bank, digital banking

Introduction

Globally, according to the United Nations, there are 727 million people aged 65 and over in the world by 2020. It is forecasted that within the next three decades, the number of people aged 65 and over will increase up to 1.5 billion, accounting for 9.3% of the total global population by 2020 to 16.0% by 2050 (United Nations, 2020). Population aging is considered the dominant demographic phenomenon and a prominent megatrend of the 21st century due to the declining birth rate, rising life expectancy and the growth in the proportion of the elderly worldwide (Dao & Barycheva, 2020). The unprecedented aging in human history brings about profound changes in population needs and capacities that significantly affect economic growth, employment, savings, and consumption, etc., and dominate the living arrangements of the elderly in countries and regions around the world (Bloom &Luca, 2016).

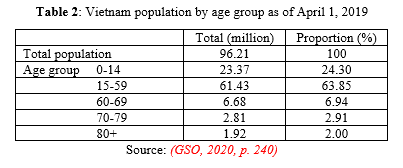

Vietnam, being a developing country with a population of over 97 million people, is not exempt from either aging process of population or its impacts. According to the 2019 Population and Housing Census, Vietnam has 7.3 million people aged 65 and older, accounting for 7.70% of the total; if calculated by the Law (the elderly defined in the Vietnam Law on the Elderly 2009 are Vietnamese citizens aged full 60 or over), the percentage of older adults in Vietnam accounted for 11.65% of the total (GSO, 2020, p. 240-241).

The world situation today is becoming more complicated while the COVID -19 pandemic is going on with unpredictable consequences and the time of it end cannot be determined. The provision of internet banking services to the older customers faces many challenges related to their health status, income diversity and property ownership and other problems encountered in the elderly. This context requires comprehensive studies on the specific demographic characteristics and other relevant factors affecting the DB adoption of the elderly to shape the adaptation of DB products and services to this customer’s group in the ever-changing demographic environment.

Literature Review

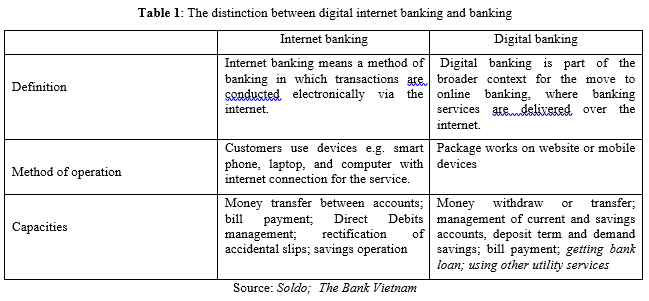

Digital banking is a general term for the development of banking services and product offerings through electronic channels, such as teller machines, telephones, internet and smart phones (Rajan, P. & Saranya, G., 2018). It is necessary to distinguish digital bank from DB. DB is the operation of digital products and services of digital banks towards customers, focusing on the front-office. Meanwhile, digital bank includes the DT of the back-office, covering internal management process, core digital technology platforms and creation of application (apps) and services of the bank in the digital environment. Being a special type of business, commercial banks are particularly interested in DT. Digital bank refers to rebuilding a bank as a digital system aimed to make daily operations faster, cheaper, easier, more convenient and efficient for both banks and customers, adapting their own operations to suit the needs of fastidious customers (Ekaterina & Tatiana, 2020), that is, all the core products and services of the bank, its management processes and business models must become digitalized.

There exist many terms such as online banking, and e-banking, internet banking nowadays. They differ in name, but in fact all imply the use of certain bank services via the internet environment and are understood as internet banking (Technospire, 2021).

The differences between internet banking and DB is that DB not only has the capabilities of conventional internet banking, but also offers a greater opportunity as it allows creating package works on website or mobile devices more and flexible apps and linking with other organizations’ online apps; customers are completely active in transactions without going to a bank branch or related organization. Moreover, DB transactions can be done anytime, anywhere, bringing efficiency, high accuracy and confidentiality for both banks and customers.

Several studies on DB adaptation to the elderly which focus on factors influencing this process, including income and personal wealth as economic factors (Vicente, M. & López-Menéndez, A., 2011); demographic factors like age, gender, habits, life expectancy, etc. influence the elderly’s ability to keep pace with technological advancements due to low knowledge of information and communication technology (ICT) (Arenas-Gaitán, J. et al,2015; Lilia, G., 2018).

Msweli and Mawela (2020) in their study conclude that the elderly inevitably has their own requirements needed to be discussed with banking service providers and e-commerce interface designers to adapt or develop products aimed at meeting the needs of the growing number of elderly people to improve their life quality. Survey results conducted by Chrysoula et al (2017) show that the majority of surveyed old-age people are interested in using online banking because they understand its benefits, giving opinion that websites and apps need to be improved to ensure a user-friendly experience, e.g. using larger fonts, contrasting colors in selections, the reduction of features and the use of an intuitive interface and of a structure offering easier navigation, etc.

Russian researchers also have works on this topic, focusing on elderly customer attitudes and behaviors towards DB. Aimaletdinov et al (2017) studying financial behaviors of older people in Russia, including the patterns of use / non-use of digital financial services and the channels for their provision as well as barriers to the use of online banking for making payments by the elderly, have identified the factors that can stimulate their adoption, paying attention to consumer perceptions of digital products and solutions to better understand how these products and solutions can be adapted to the needs of older people.

In Vietnam, there were few studies on elderly customers’ adoption of online banking, and most of them paid attention to the factors which old adults are interested in when choosing a bank and banking service in comparison to younger groups of customers (Giao &Dat, 2014). Thanh Phuong and Lan Phuong (2018) considered that Vietnam has a potential for digital banking (DB) determined by the three factors: (a) the ongoing digital transformation (DT) in all socio-economic and service sectors, including public service; (b) development of ICT infrastructure; and (c) a large population with a big number of internet and smart mobile devices users.

As Vietnamese commercial banks are moving to a comprehensive DT, researching elderly customers becomes a practical issue which allows the creation and adaptation of DB products for the elderly. The purpose of this study is to examine the factors influencing the elderly’ adoption of DB and to identify potential opportunities for Vietnamese banks in this market segment at Vietnam.

- Methodology and Materials

In this study, a systematic document review approach has been applied to review previously published literature and analyze research directions to determine the research content on demographic characteristics and Vietnam’s ICT infrastructure conditions as well as other factors that affect the elderly’ adoption of DB. The inductive method is also applied, using secondary data from the Viet Nam Population-Housing Census in 1979-2019, Report on information and communication development in Vietnam as well as international publications to identify a link between research objectives and summary results obtained from materials to make recommendations.

The limitation of this study is a lack of specific survey data on the behaviors, habits, desires or barriers to the use of DB services by Vietnamese older people, because this problem has not get the proper attention from Vietnamese bankers, and instead, the author uses the foreign colleagues’ research data to confirm the arguments.

Research Questions

Many researchers have identified many factors influencing DB adoption and affirmed that demographics, psychology and community influence are the most important (Gasper, 2015; Beza & Dhiraj, 2017; Siddharth & Ruchika, 2019). But from another angle, it can be seen that the development of ICT infrastructure, the trend of using smart devices to access the internet, the DT level of the bank are also important influences on the adaptation of online banking to the older customers and their adoption of online banking (Azedine & Fadoua, 2019).

Demographic characteristics as factors influencing DB adaptation

Demographic factors including age, gender, level of education, marital status, employment status, income level and area of residence customers’ behaviors toward have a relationship with the adoption of internet banking (Okey & Stephen, 2011).

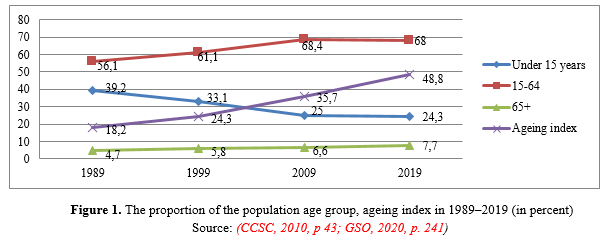

In Vietnam, a developing country, where the population seems to be younger, aging is still closely observed. The population and housing censuses from 1989 to 2019 showed an appreciable increasing proportion of the elderly from the total population and fast ageing pace.

It should be noted that out of 11.41 million people aged 60 and over, 7.66 million accounting for over 67% live in rural and mountain areas (GSO, 2020, p. 240). Most of them have low level of education, depend on relatives or have low income; older people have many difficulties in their life (Dao & Barycheva, 2020), and traditionally, they prefer to use cash in payments. Elderly people (about 3.75 million) who live in cities and receive pensions through the bank accounts are more interested in online banking services, and they are potential customers of DB.

Psychological and social factors

Psychological factors include perceived relative advantage, adaptability, perceived complexity and risk, and cost of applying online banking. Social influences including counseling, the impact of friends or relatives also partly affect the adoption of online banking by older people. (Tomasz, 2016; Rahaman et al, 2015). Studying the relationship of culture and psychology, Triandis (2001) argued that socio-cultural aspect, individual psychology, customs and habits are the factors that influence the behavior of individuals and community. Vietnamese people are characteristic of patriotism, love of labor, hard work, and responsibility for life (Amber North, 2006). Saving for the next generation is a Vietnamese lifestyle habit to be able to survive in an environment with a harsh climate. This explains why the State Bank of Vietnam has a policy to attract idle finance source from the population at attractive interest rates.

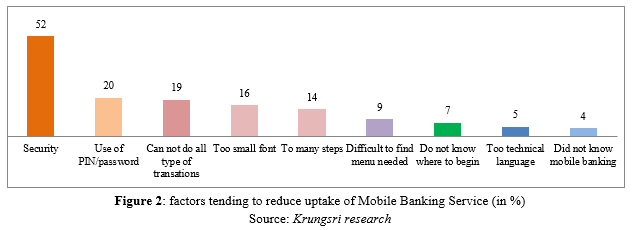

Pimnara (2020) in her study has paid special attention to the barriers that hinder the elderly’ adoption of DB, considering these as psychosocial factors and level of ICT knowledge among the surveyed old-age people, (Figure 2).

The constant changes and complex requirements of the security system used to confirm user identities force old-age users to remember e.g. passwords or some other information, complexity of mobile banking apps, hard-to-use user interfaces (small fonts and confusing language) make using online banking more complicated. That is, these aspects drive DB’s adaptation to creating products suitable for the elderly.

In Russia, the study conducted by NAFI in June 2016 has resulted on following specialties: (1) Clients aged 60-69 are the most active and involved part of the elderly population (51% of people over 60); this group is financially active with stable incomes, high level of education and internet use; (2) Clients aged 70-75 years and older are passive, the most excluded part of the elderly financial services consumers (49% of the number of people over 60 years old); it can be noted that this group are limited in physical capabilities, learning new advanced technology; and (3) Elderly people over 70 are less likely to use loans and credit cards than people aged 60-69 since they usually no longer work; at the same time, older people over 70 are more likely to use savings products than the 60-69 age groups (Aimaletdinov et al, 2017). Thus, the analysis of this survey on the activeness and the proportion of internet users by different age groups among elderly shows that there are still millions of seniors who are the target object of digital banks.

In Vietnam, some studies on the factors affecting the use of DB service have been published, but the surveys were mainly among younger customers with stable income, and the assessment was made by the degree of customers’ perception of expected efficiency, trust, risk (confidentiality), ease of use, bank’s reputation (Phu & Huan, 2019; Giao & Chau, 2020). Although these studies have not touched the elderly population group, but they partly reflect customers’ psychology and habits in choosing banks and banking services in general.

Development of ICT infrastructure and grow of smart devices in Vietnam

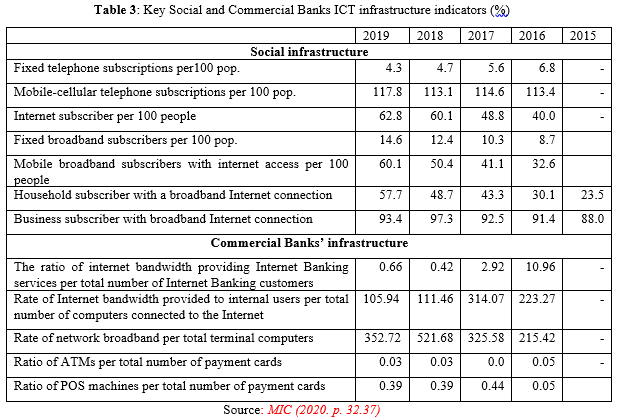

Vietnam ICT infrastructure over the years has developed rapidly, contributing to socio-economic development and improvement of people’s life. This development trend is reflected through the data in the Ministry of Information and Communication (MIC) Report. In 2019 Vietnam jumped 10 places to rank 67th (compared to 77th in 2018) out of 141 ranked countries and territories, and was among economies that have improved the most globally; the ICT indicators e.g. mobile-cellular telephone subscriptions, fixed-broadband internet subscriptions, fiber internet subscriptions per 100 population and internet users rate of adult population ranked 14, 63, 26 and 66, respectively (WEF, 2019).

The MIC 2019 Report also showed that by the year there was 134.5 million mobile subscribers, of which 121.12 million (90%) were used smart phones. This is an advantage for the banks to manage customer accounts information and provide internet banking apps.

Digital banking: an irresistible development trend of Vietnamese banks

In order to remain competitive and relevant in a new customer-centric economy, Vietnamese banks, regardless of their size, consider DT as a vital necessity, which can help to optimize their existing processes and enhance customer experience. According to Fintech Vietnam Reports (2020), 94% of banks in Vietnam are investing in digitalization and 42% of them consider DB as a top priority. DT efforts by financial institutions, including commercial banks, resulted in an impressive increase 126% and 161% respectively in mobile app and digital wallet transactions in the first nine months of 2018 (BBGV, 2019). The number of transactions via digital apps has sky-rocked since the onset of the COVID-19 pandemic, e.g. National Payment Services (NAPAS) reported that only from March to May 2020 of 45 commercial banks are used through NAPAS and the number of transactions using Internet Banking via NAPAS reached an average of 2.8 million per day (NAPAS, 2020). Vietnam’s digital bank’s ability to provide services is also confirmed by its investment in ICT infrastructure and DT.

Thus, in Vietnam, considering all three above mentioned factors, it can be emphasized that:

- The market for DB adoption is very potential due to its large population size and young, dynamic population groups and the rapid development of ICT;

- Opportunities for DB for the elderly have not been fully utilized by Vietnamese commercial banks;

- There is a relationship between the choice of using DB service by elderly and the bank’s adaptation to the elderly. It means elderly’s adoption of DB poses the need for the DB product adaptation.

Discussion

In the digital era, banks are engaged in DT for their existence and development. DT is the process of using digital technologies to transform existing traditional and non-digital business processes or creating new processes and services in response to market developments and customer expectations, thus radically changing the way the business is managed and operated, as well as the way value is delivered to the customer (Daniel & Williams, 2018). Hence, Vietnamese commercial banks need to take appropriate measures and steps to practice DT, involving digitization and digitalization.

Population aging process will be recorded more clearly in the coming years in Vietnam. The adaptation of public and social services for the elderly receives correspondingly profound attention. Admittedly, the elderly, due to their health and age, are often left behind in the process of adapting and using new technology. Since the beginning of 2020, the outbreak of the Covid-19 pandemic as an unpredictable catastrophe, has forced young and old people to become more acquainted with advanced ICT as they seek to sustain life and daily activities. This context is considered as a golden opportunity for banks to accelerate the old-age people to adapt to online banking services. In this case, it is important for Vietnamese commercial banks to conduct in-depth studies that analyze the factors affecting the elderly customers, paying attention to their characteristics, psychology and other obstacles in context the socio-economic conditions and cultural environment of the country. The specialized in-depth researches allow determining the measures that need to be taken to adapt a DB service to older customers.

The analysis of the survey results mentioned above shows that the most important barrier hindering elderly consumer’s adoption of DB is the lack of trust in digital apps of providing banks, digital devices e.g. smart phones, tablets, and the ability of ICT systems to ensure customer data security (Pimnara, 2020). Moreover, the constant changes and complex requirements of the security system used to confirm user identities force older users to remember like passwords or some other information, complexity of mobile banking apps, their hard-to-use user interfaces (small fonts and confusing language) make using online banking more complicated for older users (Aimaletdinov et al, 2017; Chrysoula Gatsou et al, 2017). So, attracting elderly users to choose DB services can be solved by:

- Improving the bank’s DT capacity; creating apps with user-friendly and easy – to use interfaces for the elderly, paying attention to simplicity, high security through the application of fingerprint unlock application or face ID;

- Preparing staff ready to advise and support older customers by setting up a “virtual transaction” that can be accessed through the user interface of a mobile banking apps specially designed for the elderly, connecting them to support staff through video calls for advice; arranging experienced consultants customers at the branch’s transaction points to meet and support older customers.

Adapting DB from the service provider for the Elderly shows only one side of the problem that is not enough. Elderly people also need to be adapted to different type digital services themselves in general.

One of the specific basic targets up to 2030 identified in the “Vietnam National Digital Transformation Program up to 2025, Vision to 2030” (approved in June 2020) is that “100% of online public services at the level 4 will be provided on many different means of access, including mobile devices. Therefore, the enhancement of personal capacity and the digital adaptation of the people in general and the elderly in particular are also the guarantee for the successful implementation of the National Program.

Conclusion

The Banking sector is one of the special sectors with rapid integration and development, and has an important influence on socio-economic development. The population of Vietnam is aging and the number of old people is increasing rapidly in the coming time. However, the segment of the banking market for the elderly has not received adequate attention. The study gives an overview of key factors influencing the elderly’ adoption of DB and confirm that older people are potential customers of DB. Recommendations in the article are intended to adapt DB services for the elderly and encourage their self-adaptation to digital services in the digital age. Taking care of the lives of the elderly, ensuring their security and keeping them from being left behind in the digital transformation process in Vietnamese society needs to be further studied in the banking service as well as many other service sectors.

References

- United Nations Department of Economic and Social Affairs, Population Division (2020). World Population Ageing 2020 Highlights: Living arrangements of older persons. ST/ESA/SER.A/451.

- Dao, Binh, T., Ngoc, T.B Tran, Galina, Barysheva A., Lam, S. T. (2020). Social Security and Population Ageing in Vietnam: A Guarantee for the Elderly People’s Life. International Journal of Criminology and Sociology, 2020, Vol. 9, 381-390; DOI: https://doi.org/10.6000/1929-4409.2020.09.37

- Bloom,D.E., Luca, D.L. (2016). The Global Demography of Aging: Facts, Explanations, Future. In Handbook of the Economics of Population Aging, Chapter 1, Volume 1, 2016, 3-56, https://doi.org/10.1016/bs.hespa.2016.06.002

- GSO (2020). Completed Results of the 2019 Vietnam Population and Housing Census. Statistical Publishing House, Hanoi, 2020, 842 p.

- Rajan, P. & Saranya, G (2018). Digital Banking Services: Customer Perspectives. 2018 JETIR, Volume 5, Issue 12, 306-311

- Ekaterina P.& Tatiana K. (2020). Factors Influencing Digital Bank Performance. 10.1007/978-3-030-37737-3_29.

- Technospire (2021). Different Ways to Bank – Digital Banking, Online Banking, Internet banking, Mobile Banking. Technospire January 17, 2021. https://teknospire.com/different-ways-to-bank-digital-banking-online-banking-internet-banking-mobile-banking/

- SOLDO. Digital banking vs online banking: What’s the difference? Accessed March25, 2021 from: https://www.soldo.com/en-gb/business-banking/digital-banking-vs-online-banking-whats-the-difference/

- The Bank (2019). What is digital banking? What is its role in modern life? Thebank.vn, https://thebank.vn/blog/15696-ngan-hang-so-la-gi-vai-tro-cua-no-trong-cuoc-song-hien-dai-nhu-the-nao.html

- Vicente, M. & López-Menéndez, A. (2011). Assessing the regional digital divide across the European Union. Telecommunications Policy, Vol. 35(3), p. 220-237

- Arenas-Gaitán, J., Peral-Peral, B., Ramón-Jerónimo, M. (2015). Elderly and internet banking: An application of UTAUT2. Journal of Internet Banking and Commerce. Vol.20 (1); 1-17.

- Lilia Georgieva (2018). Digital Inclusion and the Elderly: The Case of Online Banking. Available at: http://lrec-conf.org/workshops/lrec2018/W14/pdf/2_W14.pdf

- Msweli, N.a & Mawela, T. (2020). Enablers and Barriers for Mobile Commerce and Banking Services Among the Elderly in Developing Countries: A Systematic Review. DOI: 10.1007/978-3-030-45002-1_27.

- Chrysoula, G., Anastasios, P., Dimitrios, Z. (2017).Seniors’ experiences with online banking. In Proceedings of the Federated Conference on Computer Science and Information Systems, Vol. 11, pp. 623–627, DOI: 10.15439/2017F57

- Aimaletdinov T.A., Antonyan S.S., Baimuratova L.R., Imaeva G.R., Tomilova O.V., Sharova O.A .; Analytical Center NAFI. – M .: Publishing house NAFI, 2017 .- 84 p (Аймалетдинов Т.А., Антонян С.С., Баймуратова Л.Р., Имаева Г.Р., Томилова О.В., Шарова О.А.; Аналитический центр НАФИ. – М.: Издательство НАФИ, 2017. – 84 с..)

- Giao, H. N. K.& Dat, H. M. (2014). Evaluation of commercial banking selection factors for the elderly in Ho Chi Minh City. Economic Development Journal, Vol. 280 (4), 2014, 97-115.

- Thanh Phuong, N. & Lan Phuong D. T. (2018). Digital Banking in Vietnam Current Situation and Recommendations. International Journal of Innovation and Research in Educational Sciences,Vol. 5 (4): 2349–5219

- Gasper Chuwa (2015). Factors Influencing the Adoption of Internet Banking by Small and Medium Enterprises (SMEs) in Nyamagana District, Mwanza-Tanzania. European Journal of Business and Management, Vol.7, No.13, 2015. 135-159.

- Beza M. T. & Dhiraj S. (2017). Influence of Demographic Factors on Users’ Adoption of Electronic Banking in Ethiopia. The Journal of Internet Banking and Commerce, https://www.icommercecentral.com/peer-reviewed/influence-of-demographic-factors-on-users-adoption-of-electronic-banking-in-ethiopia-85527.html

- Siddharth, V. & Ruchika, G. (2019). Impact of demographic variables on factors of customer satisfaction in banking industry using confirmatory factor analysis. International Journal of Electronic Banking. 1. 283. 10.1504/IJEBANK.2019.10022902.

- Okey, O.& Stephen, T. (2011). Effects of demographic factors on bank customers’ attitudes and intention toward Internet banking adoption in a major developing African country. Journal of Financial Services Marketing. 16. 10.1057/fsm.2011.28.

- CCSC (Central Population and Housing Census Steering Committee). (2010). The 2009 Vietnam Population and Housing Census: Major findings. Hanoi, 2010, p. 492.

- Tomasz, S. (2016). Factors affecting the adoption of online banking in Poland. Journal of Business Research. 10.1016/j.jbusres.2016.04.027.

- Rahaman, Md & Murad, S. M. Woahid & Asaduzzaman, M.. (2015). Factors Affecting Customer Choice of Commercial Banks in Bangladesh. BUBT Journal. 7. 155 – 176.

- Triandis, H. C. (2001) Individualism-Collectivism and Personality. Journal of Personality, 69(6): 907–924.

- Pimnara Hirankasi (2020). Banking for the elderly in the digital era.Krungsri Bank, available at: https://www.krungsri.com/en/research/research-intelligence/ri-elders-20

- Phu, L.C. &Huan D. D. (2019). Factors Affacting the Decision to Use Smart Banking Service by Individual Customers atT AGRIBANK – Can Tho Branch. Journal of Industry and Commerce, Vol. 17 (9), 2019

- Giao, Ha & Chau, Tran. (2020). Factors Affecting the Decision to Use Smart Banking Service – Experimental Study at BIDV – North Saigon Branch. SSRN Electronic Journal, 220, 13-27.

- WEF [World Economic Forum] (2019). 2019 Global Competitive Index. Ed. by Klaus Schwab, Geneve, 2019

- MIC (2020). Report on Vietnam’s Readiness for Development and Application of Information and Communication Technologies (Viet Nam ICT Index). Vietnam Information and Communication Publishing House, Hanoi,2020.

- Fintech Vietnam (2020). Top 5 banks apply digital banking transformation in Vietnam. Fintechvietnam, September 25, 2020. https://fintechvietnam.com.vn/top-5-banks-apply-digital-banking-transformation-in-vietnam/

- BBGV [British Business Group Vietnam] (2019). Vietnam – 2019 Fintech. Available at: https://britchamvn.com/wp-content/uploads/2020/12/Vietnam-2019-%E2%80%93-FinTech.pdf

- NAPA (2020), ‘Digital banking and electronic payments – suggestions from the COVID -19 crisis’, NAPAS’ e-portal, URL: https://napas.com.vn/tin-tuc/tin-thi-truong/ngan-hang-so-va-thanh-toan-dien-tu—goi-mo-tu-khung-hoang-covid–19-2-690.html

- Daniel R. A. Schallmo & Christopher A. W. (2018). Digital Transformation Now! Guiding the Successful Digitalization of Your Business Model. SpringerBriefs in Business. DOI: https://doi.org/10.1007/978-3-319-72844-5