Original article

Научная статья

УДК 330

doi: 10.55186/2413046X_2022_7_12_731

FUNDAMENTAL FACTORS OF THE P/E MULTIPLIER AND THEIR USE IN SEARCH FOR UNDERVALUED ASSETS

ФУНДАМЕНТАЛЬНЫЕ ФАКТОРЫ МУЛЬТИПЛИКАТОРА P/E И ИХ ИСПОЛЬЗОВАНИЕ В ПОИСКЕ НЕДООЦЕНЕННЫХ АКТИВОВ

Kolyeva Natalya, PhD, Candidate of Pedagogical Sciences, Associate Professor of the Department of Information Technologies and Statistics, Ural State University of Economics, nkoleva@mail.ru

Gorodnichev Viktor, Senior Lecturer, Department of Information Technologies and Statistics, Ural State University of Economics

Panova Marina, Senior Lecturer, Department of Information Technologies and Statistics, Ural State University of Economics

Кольева Наталья, доктор, кандидат педагогических наук, доцент кафедры информационных технологий и статистики, Уральский государственный экономический университет, nkoleva@mail.ru

Городничев Виктор, старший преподаватель кафедры информационных технологий и статистики, Уральский государственный экономический университет

Панова Марина, старший преподаватель кафедры информационных технологий и статистики, Уральский государственный экономический университет

Abstract. This article discusses the process of selecting, creating and constructing independent variables for the specification of models for predicting the fair value of stock multiples. The successful application of such methods can be used to identify both undervalued and overvalued stock market assets. The main factors that determine the value of the price/earnings ratio are formed and serve as the basis for creating investment strategies that claim to systematically extract positive excess returns. The process of searching for undervalued assets is demonstrated on the example of the Russian stock market. This, in turn, may entail the creation of completely new methods, principles and approaches to management in order to maximize its intrinsic value.

Аннотация. В данной статье рассматривается процесс отбора, создания и конструирования независимых переменных для спецификации моделей прогнозирования справедливого значения фондовых мультипликаторов. Успешное применение таких методов может использоваться для идентификации как недооцененных, так и переоцененных активов фондового рынка. Сформированы основные факторы, определяющие величину соотношения цена/прибыль и служат основой для создания инвестиционных стратегий, претендующих на систематическое извлечение положительной сверхдоходности. Демонстрируется процесс поиска недооцененных активов на примере российского фондового рынка. Это, в свою очередь, может повлечь за собой создание совершенно новых методов, принципов и подходов к управлению с целью максимизации ее внутренней стоимости.

Keywords: asset valuation, relative valuation, multiples, P/E, price/earnings, stock market, securities market

Ключевые слова: оценка активов, относительная оценка, мультипликаторы, P/E, цена/прибыль, фондовый рынок, рынок ценных бумаг

Fundamental PE Multiplier Factors

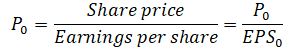

Consider the main factors that determine one or another value of the coefficient PE. In order to show that the use of multipliers is inextricably linked with the method of discounting cash flows, we also formulate the definition of the multiplier PE [1-4]:

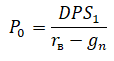

Also, using the simplest model of discounting dividends, we write down the value of the stock at time t = 0:

Where,

DPS1 – expected next year dividend;

rв – cost of equity;

gn – stable dividend growth rate.

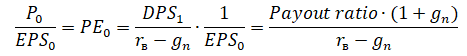

Divide both sides of the equation by earnings per share[1]:

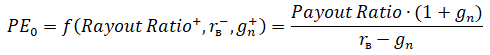

Thus[2], the PE multiplier is a function of the dividend payout ratio, the cost of equity and the growth rate of earnings per share:

Fix the main observations obtained during the analysis:

- The PE value is an increasing function of the dividend payout ratio – ceteris paribus[3], the greater the ratio of the cost of share to earnings on share it will have;

- The function is decreasing from the cost of capital – the more risky an asset or enterprise is in the eyes of a marginal investor, the smaller the multiplier;

- Higher earnings growth increases the ratio of share price to earnings per share[4] [5-8].

Note that, depending on the fundamental factors, the multiplier can justifiably take any value from the set of real numbers.

Next, we consider, in our opinion, the most rational use of multipliers based on the results obtained, demonstrate examples of their use on the example of Russian stock market companies, and highlight its potentially undervalued assets.

Statistical Methods

Using statistical methods, in particular the regression analysis method, we will try to explain the value of the dependent variable – the PE multiplier using one or more independent variables:

As was hown, PE is a positive function of the dividend payout ratio, profit growth rate, cost of equity:

Obviously, in the reality surrounding us, we cannot observe the equilibrium, stable[5] to the coefficient of dividend payments, the cost of equity and the perpetual growth rate of net profit. The most difficult and worthwhile task is to find visible objective fundamental characteristics of the company that correlate with the boundless determinants of the multiplier. Using some of the considered observable variables, we will compose a model for predicting the PE coefficient based on the 43 largest companies on the Russian stock market of the Moscow Exchange [9-11].

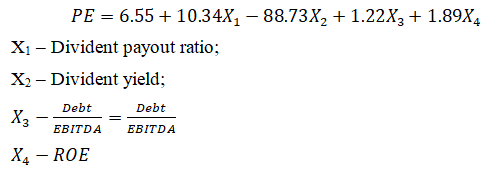

One of the possible[6] models is as follows:

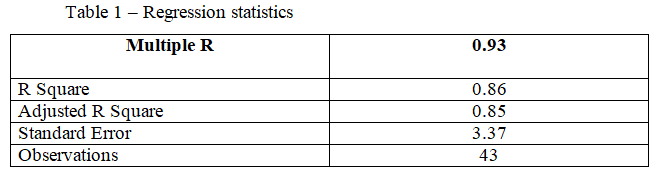

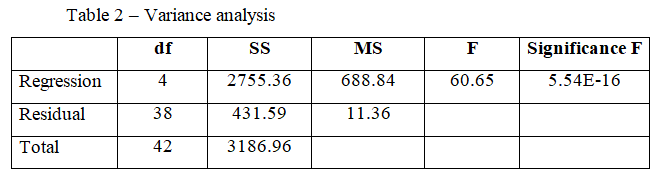

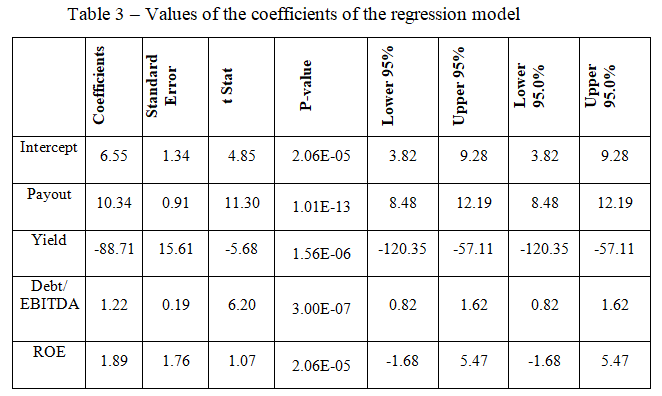

Tables 3 and 4 show that a high value of Fisher’s F-statistics and an extremely high value of multiple and adjusted R2 (0.93 and 0.85) for financial data indicate the validity of using this model.

Now, substituting the values of the independent variables for each company into the obtained regression equation, we obtain the predicted multiplier values for each company from the sample. One of the possible interpretations of the discrepancy between real and forecast values may be the undervaluation of company shares. Figure 3 groups assets in descending order of balances. According to this methodology, Rosseti, MOESK, Surgutneftegas and Gazprom are the most undervalued assets. Assets highlighted in red are potentially overvalued. Reviewing strategies using short sales of these assets and opening long positions on undervalued securities is one of the possible strategies. Testing a portfolio assembled by a similar principle for the possibility of extra profit is of particular interest and deserves a separate study.

The use of statistical methods, in our opinion, is the most reasonable approach when using multipliers:

- The flexibility of the approach allows the use of regression analysis both within a specific sector or industry, and the market as a whole;

- The ability to constantly update the specification and the result of the model provides dynamism.

It is important to note a compromise between the explanatory power of the model and its economic feasibility. For example, the relationship between ![]() and the PE multiplier is not obvious. The simplest explanation may be the tendency of fast-growing companies to have a high level of debt compared to EBITDA. Nevertheless, this is most likely in no way connected with the overestimation or underestimation of the company. If the analyst’s goal is to search for overestimated or underestimated companies, we recommend removing such variables from the model specification, resigned to the fall of R2 or Fisher F-statistics.

and the PE multiplier is not obvious. The simplest explanation may be the tendency of fast-growing companies to have a high level of debt compared to EBITDA. Nevertheless, this is most likely in no way connected with the overestimation or underestimation of the company. If the analyst’s goal is to search for overestimated or underestimated companies, we recommend removing such variables from the model specification, resigned to the fall of R2 or Fisher F-statistics.

Different from the expected signs of the values of some coefficients for independent variables may be due to multicollinearity. A number of researchers believe that there is nothing wrong with the fact that the coefficients are not accurately estimated, no. An alternative is to change the specification of the model, get rid of some variables, or to override the variables.

Conclusion

Based on an overview of existing methods for evaluation of assets, the inextricable relationship between the family of cash flow discounting methods and the use of multipliers is shown, i.e., the value of the P/E multiplier is completely determined by the same characteristics that form the intrinsic value of any asset:

- The expected cash flows generated by this asset;

- Risk and cash flow uncertainty;

- Cash flow growth rate.

A robust alternative to empirical rules and appeal to intuition is to control the difference using the fundamental characteristics of the company and the use of statistical methods.

Further consideration of the topic of using multipliers in the context of asset valuation is planned in the following three areas:

- Algebraic decomposition and aspects of the application of other multipliers;

- Testing strategies based on the design of various portfolios using the set of multiplier application methodology;

- In-depth analysis of determinants of multipliers for solving problems in management.

References

- Khodakovsky V., Kudarov R., Kudarov R. Gerasimenko P. (2019), V Econometrics, St. Petersburg: Emperor Alexander I St. Petersburg State Transport University.

- Benson D.F. (2010) Corporate Venture Capital and the Acquisition of Entrepreneurial Firms A dissertation submitted in partial fulfilment of the requirements for the degree of Doctor of Philosophy (Business Administration) in The University of Michigan.

- Oliver E.W. (2013) The Transaction Cost Economics Project: The Theory and Practice of the Governance of Contractual Relation. USA: Edward Elgar Pub. 444 p.

- Kolyeva N. (2021) Organization of multi-access in databases. 3S Web of Conferences, 2021, 270, 01006.

- Damodaran A. (2010) Investitsionnaya otsenka: Instrumenty i metody otsenki lyubykh aktivov: per. s angl. 6-e izd. M.: Al’pina Pablisherz. 1338 p.

- Eleneva Yu.Ya. (2010) Otsenka kompanii metodom mul’tiplikatorov: zarubezhnyi opyt i praktika // Audit i finansovyi analiz.

- Duren P.L. (1970) Theory of spaces, New York and London, Acad. press.

- Kislitsyn E.V. (2016) Modern approaches to definition of the market. Topical issues of economic sciences. No. 51. Р. 34-38.

- Novikov I., Semenov E. (1997) Haar series and linear operators. Dordrecht: Kluwer Acad. Publ.

- Misakov V.S. (2007) Comparison as a General scientific method of cognition. // Izvestiya Kabardino-Balkarian scientific center of the Russian Academy of Sciences. No. 3. P. 16/

- Krugman P.R., Wells R. (2012) Economics. Worth Publishers. 1157 p.

Для цитирования: Kolyeva N., Gorodnichev V., Panova M. Fundamental factors of the P/E multiplier and their use in search for undervalued assets // Московский экономический журнал. 2022. № 12. URL: https://qje.su/ekonomicheskaya-teoriya/moskovskij-ekonomicheskij-zhurnal-12-2022-34/

© Kolyeva N., Gorodnichev V., Panova M., 2022. Московский экономический журнал, 2022, № 12.

[1] Payout ratio – divident payout ratio (percentage of net profit paid to shareholders in the form of dividends)

[3] Ceteris paribus – is a very important assumption. Paying a large part of the profits imposes serious restrictions on the growth potential of the company. Next, we show the relationship between profitability, dividend payout ratio, and net profit growth rate in explicit form

[4] Under ![]()

[5] Suitable for the assumptions of the Gordon model

[6] It is possible to change the specification of models using the nonlinear influence of dependent variables on an independent one